Bad Debt Written Off Double Entry

Try Another Double Entry Bookkeeping Quiz. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative.

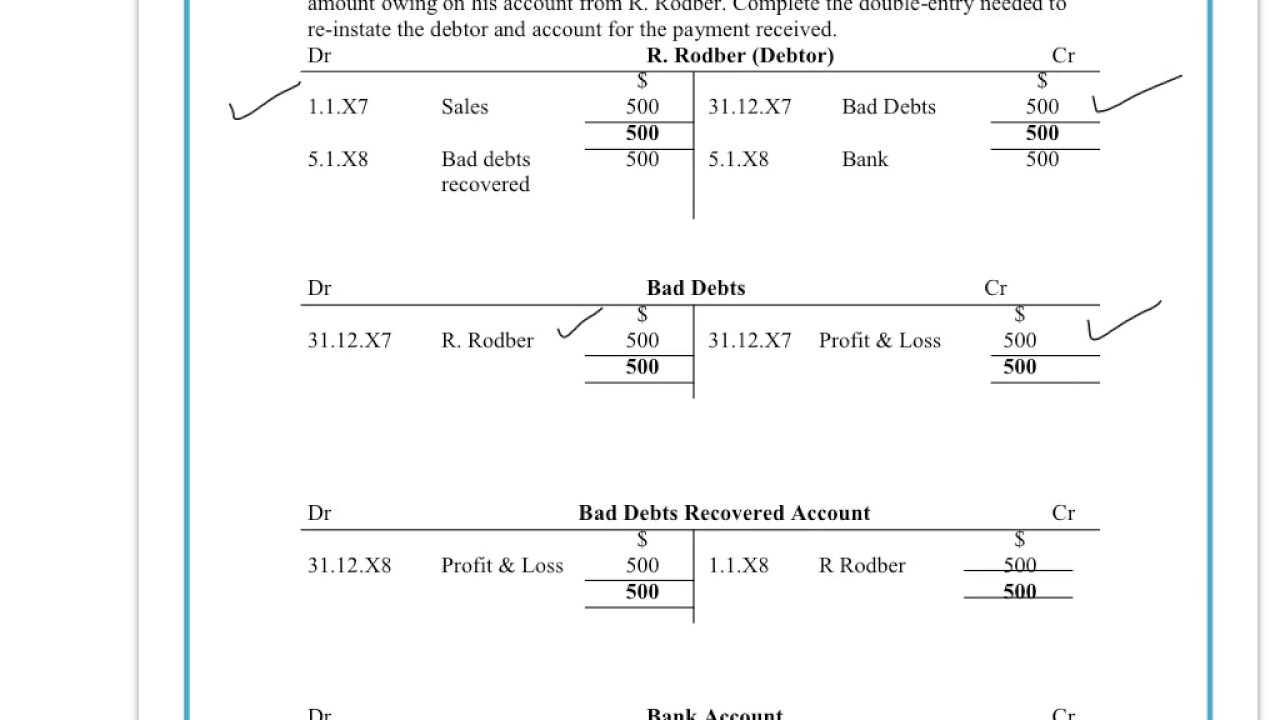

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

Debit Bad debt provision BS 100.

. In either case the company will recognize it as income for the business. If something you have done pays off it is successful. The double entry will be.

To reduce a provision which is a credit we enter a debit. You will note we are crediting an expense account. Central on The CWThe series was produced by ABC Studios and The Mark Gordon Company.

Reaper is an American comedy television series that focuses on Sam Oliver a reaper who works for the Devil by retrieving souls that have escaped from Hell. The journal entry to record the bad debt recovered is debit cash and credit other income. May 02 2022 3 min read.

The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below. Estimating the time it takes to get a divorce includes factors such as where you live if your state has a cooling off period or required period of Jul 15 2022 5 min read 9 Divorce FAQ Answers to Frequently Asked Questions About Alimony Child Custody and Child Support. Heres how to do it.

It is not directly affected by the journal entry write-off. This blog entry details how Trend Micro Cloud One Workload Security and Trend Micro Vision One effectively detected and blocked the abuse of the CVE-2020-14882 WebLogic vulnerability in affected endpoints. Continuing in one direction without bending or curving.

The series ran from September 25 2007 to May 26 2009 airing on Tuesday nights at 800 pm. The Bad Debts Expense remains at 10000. May 02 2022 4 min read.

To pay back money that you owe. How to Get a Divorce Online If your divorce is uncontested filing online may be the way to go. When it comes time to go your separate ways someone has to take responsibility for your debt.

This recovered amount may be a partial payment received against the total of the written-off amount or it may be a lower amount agreed with the company for the total written-off amount. Expanded Accounting Equation Quiz. A write-off is a deduction in the value of earnings by the amount of an expense or loss.

This is acts a negative expense and will increase profit for the period. Trial Balance Debit and Credit Quiz. If you tell someone.

The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this.

A Post-exploitation Look at Coinminers Abusing WebLogic Vulnerabilities. When businesses file their income tax return they are able to write off expenses incurred to. The other side would be a credit which would go to the bad debt provision expense account.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Writing Off An Account Under The Allowance Method Accountingcoach

No comments for "Bad Debt Written Off Double Entry"

Post a Comment